“Over the years we’ve invested significantly in our field data team - focusing on producing trusted ratings. While this ensures the accuracy of our Ratings, it doesn’t allow the scale across the thousands of projects that buyers are considering.”

For more information on carbon credit procurement trends, read our "Key Takeaways for 2025" article. We share five, data-backed tips to improve your procurement strategy.

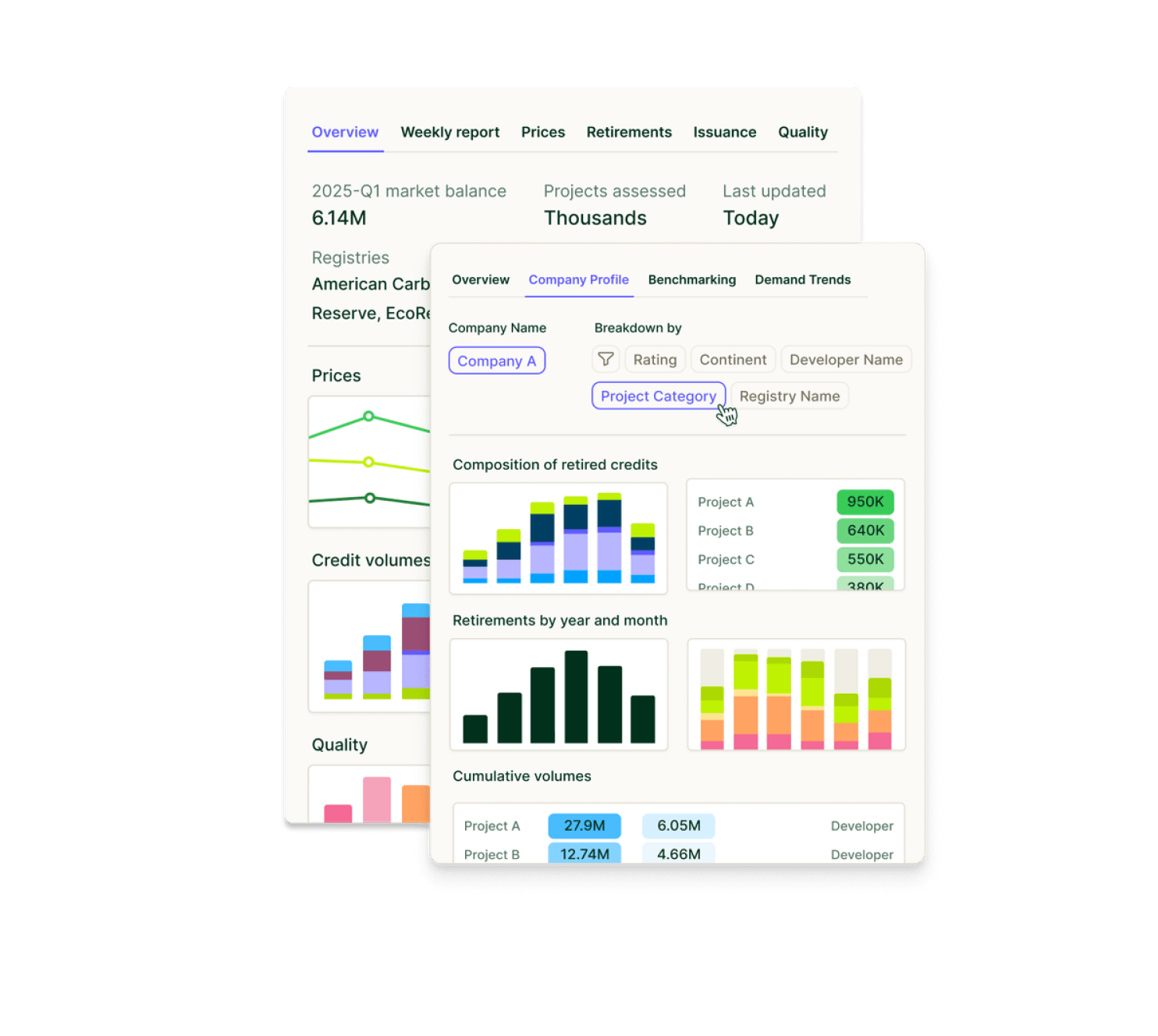

One more thing: Connect to Supply customers also get access to the rest of Sylvera's tools. That means you can easily see project ratings and evaluate an individual project's strengths, procure quality carbon credits, and even monitor project activity (particularly if you’ve invested at the pre-issuance stage.)

Book a free demo of Sylvera to see our platform's procurement and reporting features in action.

If you're part of a procurement or sustainability team deep in budget planning mode, you're probably wondering, "How do I budget for a volatile and complex carbon credit market in which prices vary widely by project type, quality, and compliance eligibility?"

That's easy: you plan strategically using carbon market forecasting that accounts for the multiple factors shaping carbon credit prices into the future.

For all the market data around carbon credit pricing, quality, and demand trends, check our comprehensive State of Carbon Credits report.

Why carbon credit budgeting is different (and harder)

Unlike most procurement categories, carbon credits don't have a single price on the voluntary carbon market (VCM). A "$24 per tonne" headline obscures enormous variation.

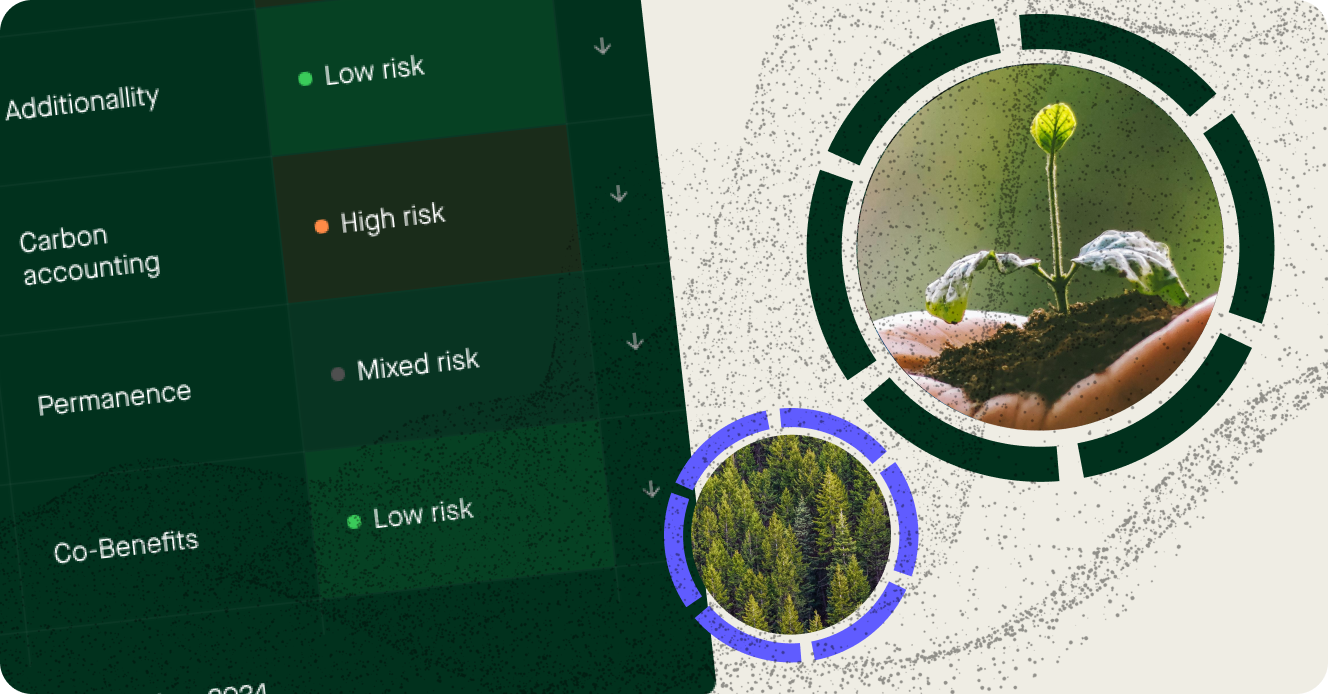

Actual procurement costs depend on:

- Quality ratings: AAA-rated ARR projects command $10 more per rating band than BBB equivalents.

- Compliance eligibility: CORSIA-eligible credits can trade at premiums up to 150% above non-eligible alternatives.

- Vintage: Recent vintages (2022-2024) command significant premiums over 2018-2019 credits.

- Co-benefits: Projects with verified biodiversity outcomes, for example, capture measurable price lifts.

- Geography: African ARR projects trade at $37/tonne vs. $14/tonne in Asia.

So, the cost to cover your company's internal carbon price in 2026 and beyond depends on at least five variables, most of which are evolving.

The traditional approach to carbon credit budgeting (and why it fails)

Most teams handle carbon budget planning in one of three ways: using current spot prices, applying generic inflation factors, or relying on broker quotes. While each will help you purchase carbon offsets and hit net zero emissions, none are the best approach in terms of budget.

Option 1: Using current spot prices

Problem: Carbon markets are in transition. Current prices don't reflect emerging compliance demand (CORSIA scaling, Article 6 implementation), supply constraints in high-quality carbon projects, or technology cost curves for engineered greenhouse gas emissions removals.

Option 2: Applying a generic inflation factor

Problem: Carbon credit pricing doesn't follow inflation. Supply-demand dynamics, policy changes, and quality differentiation create non-linear price movements that simple escalation factors miss.

Option 3: Relying on broker quotes

Problem: Brokers provide point-in-time estimates for specific transactions. They don't help you understand how your target project mix will evolve over a multi-year commitment, or how different scenarios (high vs. low compliance demand) affect your budget risk.

All three approaches share the same flaw: they treat carbon procurement as a single-year, single-scenario exercise rather than a multi-year strategic commitment that needs stress-testing.

A better framework: Scenario-based budget planning

Smart organizations are shifting to scenario planning that addresses three critical questions:

1. What project mix aligns with our quality standards and budget constraints?

Budget planning should start with your procurement criteria:

- Target quality thresholds (e.g., BBB+ or higher)

- Project type preferences (e.g. nature-based vs. carbon dioxide removal)

- Compliance requirements (e.g. CORSIA-eligible for aviation offsets)

- and co-benefit priorities (e.g. biodiversity and community impact)

Once you've defined your criteria, you need forward visibility into what that portfolio will cost, not just next year, but through your commitment period.

Sylvera’s Market Forecasts provide project-type-specific pricing through 2050, letting you model what your target mix will cost under different market conditions.

So, if your strategy calls for 60% high-quality forestry and 40% biochar, you can see what that portfolio costs in 2026, 2027, and 2030—under low, medium, and high demand scenarios.

2. How do different market scenarios affect our budget exposure?

Carbon markets face genuine uncertainty, with questions like:

- Will Article 6 drive significant new compliance demand?

- How quickly will CORSIA scale from pilot to full implementation?

- What happens if a group of major buyers enter the market aggressively?

- How fast will engineered removal costs decline?

Rather than choosing a single price forecast and hoping it's right, scenario planning lets you understand your budget exposure across different futures.

In fact, Market Forecasts delivers three demand scenarios (low, medium, high) with corresponding supply and pricing projections. This lets you identify budget risk flags. If your target project types show 40% price increases in the medium scenario by 2028, that's critical intelligence for long-term planning.

Plus, you can stress-test commitments. Before signing a 5-year offtake agreement, for example, you can model what happens if high-demand scenarios materialize. And you can build board-ready justifications. Show leadership why you're budgeting $X in 2026 and $Y in 2028, with credible scenarios supporting your assumptions and emissions reduction goals.

3. When should we time our procurement to optimize carbon pricing?

Timing is paramount in carbon markets. Why? Because supply-demand imbalances don't appear uniformly across project types or regions. There might not always be an abundance of renewable energy projects to generate carbon offsets for your company—especially not in every country.

With granular forecasts by project type and geography, you can identify pre-buy opportunities.

For example, project types where supply constraints will drive future price increases. Or engineered removals, where costs are declining and early commitment isn’t viable for every buyer.

For instance, a buyer could use this intelligence to lock in AAA-rated forestry credits at $29/tonne in Q4 2025, having anticipated tightening supply in their target geography. By 2027, comparable credits in medium-demand scenarios might be $38/tonne, as projected. In this scenario, the buyer will have made a strategic decision worth hundreds of thousands of dollars.

How leading teams are using Market Forecasts in budget planning

Corporate procurement: Multi-year budget confidence

A technology company's sustainability team faced a familiar challenge: their 2027 carbon commitment required procuring 50,000 tonnes annually through 2030 to help offset its own carbon footprint. Finance wanted a defensible multi-year budget with variance bands.

Using Market Forecasts, they modeled their target mix (70% ARR at BBB+ minimum, 30% biochar), generated pricing projections across three scenarios, presented leadership with a base case ($1.35M annually) and risk range ($1.15M-$1.65M) based on medium vs. high demand scenarios. They justified budget increases in outer years tied to CORSIA implementation and Article 6 timelines.

The result: an approved multi-year budget with built-in flexibility, and a defensible framework for explaining variance to the CFO.

Investment funds: Portfolio stress-testing

A carbon credit investment fund used Market Forecasts to validate their investment thesis before an IC meeting. They were evaluating a $4M deployment across biochar projects with projected returns based on $190 credit assumptions.

Forward curves showed biochar credits at $165 by 2028 in the low scenario (below their hurdle rate), $210 by 2028 in the medium scenario (meeting projections), and $285 by 2028 in the high scenario (strong upside).

This intelligence helped them structure the deal with downside protection (prepayment discounts if low scenario materializes) and upside participation (higher offtake prices if high scenario emerges).

Project Developers: Revenue Modeling for Fundraising

A project developer raising $8M for a Southeast Asian ARR project used Market Forecasts to strengthen their investor pitch.

Rather than showing a single revenue projection, they presented a conservative case with pricing aligned to low-demand scenarios ($18/tonne through 2029), a base case using medium-demand pricing ($24/tonne by 2029), and an upside case with high-demand pricing driven by strong Article 6 implementation ($32/tonne by 2029).

Investors appreciated the scenario transparency and the grounding in third-party projections rather than optimistic internal assumptions. The project closed funding at favorable terms and is now working to help lower global emissions.

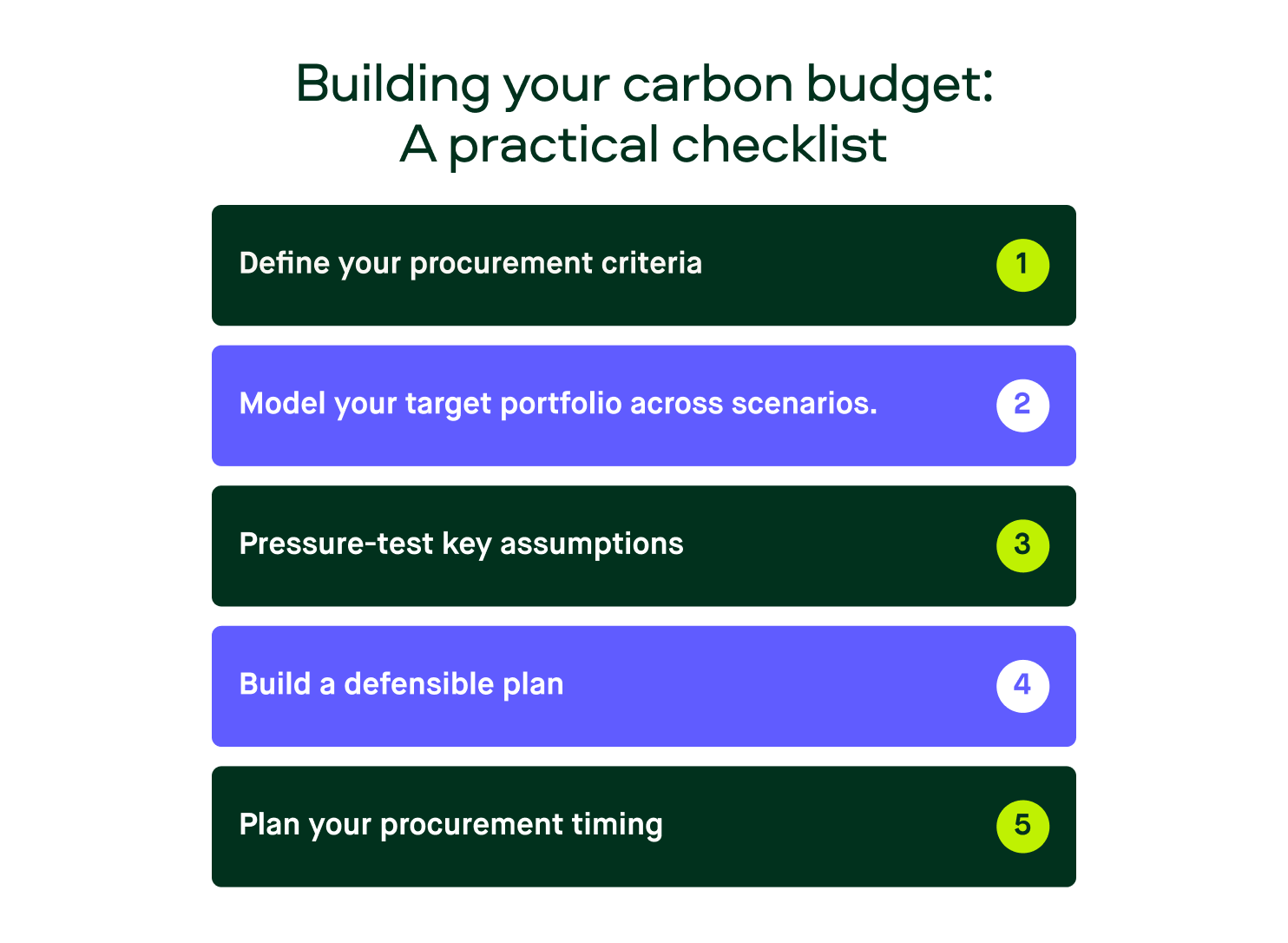

Building your carbon budget: A practical checklist

As you finalize budgets into next year, use this framework:

- Define your procurement criteria. Quality thresholds (minimum ratings), project type preferences and portfolio mix, compliance requirements, and volume commitments and timing.

- Model your target portfolio across scenarios. Use Market Forecasts for your specific project mix. Understand the range of outcomes (low/medium/high scenarios). Identify which project types drive the most budget variance.

- Pressure-test key assumptions. What happens if CORSIA scales faster than expected? How does Article 6 implementation affect your target projects? Which geographies face supply constraints in your timeline?

- Build a defensible plan. Create board-ready scenarios with transparent assumptions. Show leadership the drivers behind these forecasts. Explain variance bands and risk mitigation approaches.

- Plan your procurement timing. Identify pre-buy opportunities where early commitment makes sense. Flag categories where waiting could reduce costs. Structure multi-year agreements with appropriate pricing mechanisms. All while meeting goals to offset your own emissions.

Get started with Carbon Market Forecasts

With the right intelligence, you can build multi-year budgets grounded in real market dynamics, stress-test your assumptions across scenarios, and make strategic decisions that optimize both costs and combat the climate crisis.

As you finalize your budgets, the question isn't just ‘What will carbon credits cost next year?’ It's ‘How do I build a strategy that's resilient across different market conditions?’

Sylvera’s Market Forecasts give you the forward visibility to answer that question with confidence.

About Market Forecasts

Market Forecasts deliver comprehensive carbon market scenarios through 2050, giving you the forward visibility needed to navigate uncertainty and choose high quality carbon credits.

Comprehensive market outlook across scenarios

Get granular pricing, supply, and demand projections for 10+ project types. From nature-based solutions (ARR, REDD+, IFM) to engineered carbon removal projects (BECCS, DACCS, Biochar), across global regions through 2050.

Low, medium, and high demand scenarios help you stress-test assumptions and plan for different market conditions while still hitting climate targets.

Bottom-up methodology grounded in real market data

Unlike top-down forecasts, our agent-based model simulates individual buyer behavior based on preferences, compliance obligations, and purchasing patterns.

Calibrated to 2026 market conditions and fed by live integrations with approximately 20 registries and 40,000+ company profiles, Market Forecasts reflects actual market structure and participant behavior.

Actionable insights, instantly accessible

Download standardized scenarios with full assumptions, charts, and data tables. Share credible forward curves with investment committees, boards, or counterparties without waiting for bespoke analysis.

Ready to build your carbon budget with scenario-based modelling? Schedule a demo to see how Market Forecasts can transform your budget planning process.

Maximize your budget to offset carbon emissions

Carbon credit budgeting doesn't have to be a guessing game. Organizations that embrace scenario planning can confidently navigate market uncertainty while advancing climate action.

Whether you're preparing to participate in emissions trading systems for the first time or realign with corporate net zero claims, Market Forecasts gives you forward visibility to make strategic decisions that optimize costs and deliver genuine climate change impact.

As carbon markets mature and compliance demand grows, the companies that plan proactively will be best positioned to secure quality credits at competitive prices.

For all the market data around carbon credit pricing, quality, and demand trends, check our comprehensive State of Carbon Credits report.