The clearest, most actionable view of the carbon market

20,000 credit prices, up to date buyer activity, and filterable trends across 19 registries – no more stitching sources.

Go from market-wide trends to project-type prices, retirements, and ratings context with filters that match your strategy.

Regular updates and live data to keep you ready for policy shifts, supply changes, and timing decisions.

Never miss a beat in the carbon markets

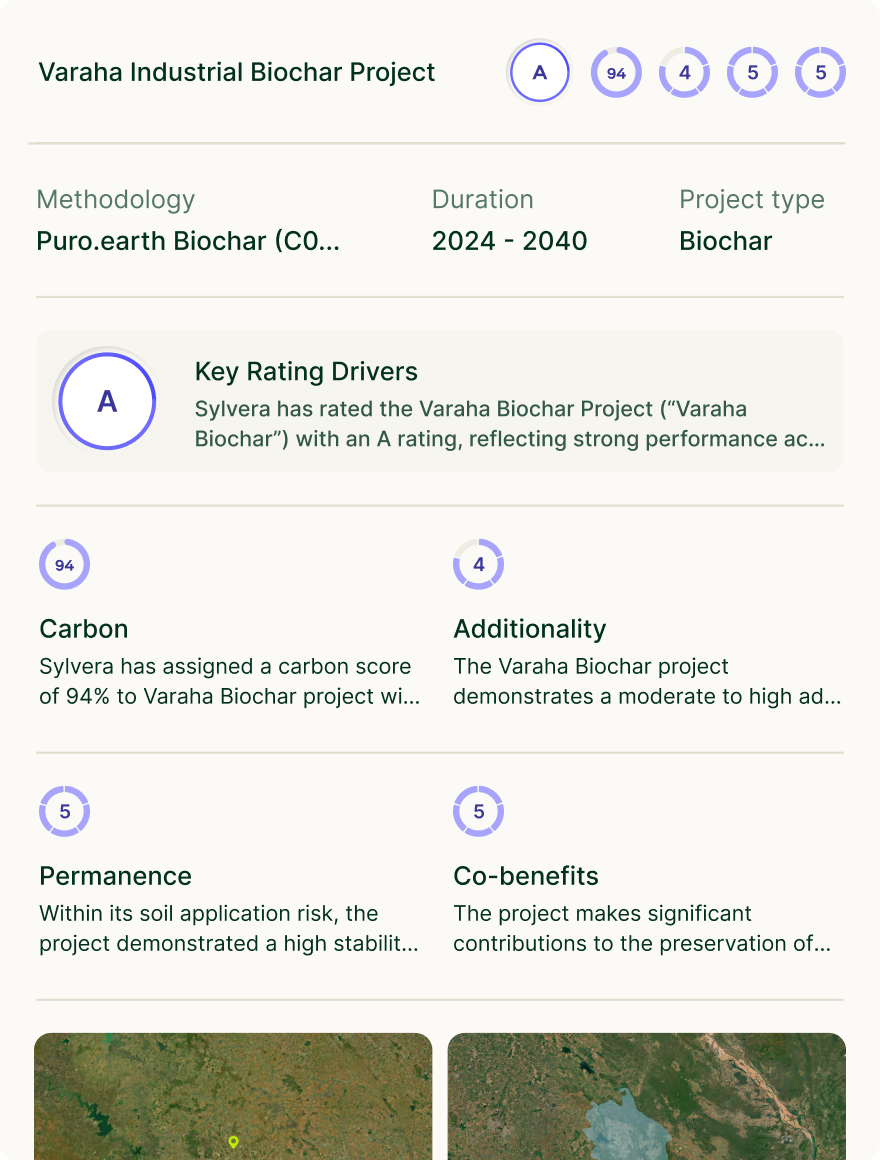

Combined with our robust Ratings, Country and Methodology profiles, Connect to Supply, and Market Commentary, with Market Intelligence, customers get an all-in-one platform to operate confidently in the carbon market.

Pricing data – With price estimates for over 20,000 credits, powered by 300,000 price transactions, and 7 price indices, users get unprecedented price transparency.

Market Data – Live data on issuances, retirements, and price trends across 19 registries, filterable by project type, registry and location.

Buyer Directory – See buying activity for over 39,000 retirees and filter by sector, type, vintage, and geography to analyse demand trends.

You need to make faster, defensible decisions in a market that moves daily. Sylvera unifies price, market data, policy, and quality in one view – so you can act with confidence.

Improved price transparency – Accurately value and ensure a fair price across over 20,000 credits.

Uncover buyer preferences – Identify demand from over 39,000 buyers, benchmark activity, and turn prospects into customers.

Track market activity in real time – Track market imbalances and carbon credit transactions from across 19 registries to make smarter decisions.

Act faster – Pair trusted ratings with regulatory information, supplier access, and prices in one workspace to maximize the speed of your decisions.

Market Forecasts delivers supply, demand, and pricing outlooks through 2050 across 10+ project types, six regions, and three demand scenarios.

Defend multi-year budgets – Stress-test procurement strategies with transparent, board-ready assumptions.

Time deployment effectively – Identify when supply-demand imbalances emerge across your target project mix.

Support IC decisions – Strengthen revenue models and offtake negotiations with credible third-party forward curves.

For Offtakers – Procure with confidence. Use independent pricing benchmarks, eligibility signals, and Known Supply data to avoid overpaying, manage reputational risk, and secure the right projects for your net-zero strategy.

For Investors & Traders – Treat carbon like an asset class. Mark to market with integrity-adjusted comps, negotiate tighter spreads, and plan entries with forward curves coming soon.

For Project Developers – Prove your project’s value. Benchmark against peers, validate pricing with market-wide data, and strengthen fundraising materials with trusted, independent intelligence.

A full suite of carbon market intelligence.

“Investors need assurance that their contributions to the carbon market will yield tangible results. Our partnership with Sylvera allows us to provide that assurance by backing our insurance products with the most reliable data available.”

Understanding Carbon Credit Pricing: A Playbook for the Carbon Market

Common questions about Market Intelligence.

Our models are built to be transparent and testable:

- Confidence bands: We group predictions into low, mid, and high confidence ranges so you can see the certainty level.

- Selective coverage: We only publish estimates where there is sufficient high-quality data. Where the market is too thin, we don’t guess.

- Backtesting: We have tested how well our models have performed against historical data to verify accuracy.

Not here. Our approach is a blend of automation and expert review:

- Where recent trades exist, the model extrapolates directly from those prices — the same way a human analyst would.

- Where trading is thin, our analysts apply additional checks and context to ensure the estimate reflects real market conditions.

- Deterministic, not generative: Unlike LLMs, our models don’t “hallucinate.” They use structured numerical techniques to produce repeatable, auditable results.

Advanced statistical techniques may appear opaque, but we ensure it could be understood easily in simple terms:

- Simple principle: Recent prices for the same project (or very similar projects) form the anchor for all estimates.

- Robust inputs: Over 300,000 market datapoints across 18 months feed the model.

- Peer-reviewed methods: Our approach adopts advanced statistical techniques that are well-established and standardized within the AI community. They may be less easily understood than historical averages or linear regressions, but they are proven to provide a closer predictions.

We’re using Market Data, too. See our latest data-driven insights here.

Request a demo and free trial

Get a demo or free trial to see our market-leading pricing data, buyer directory and market forecasts in action.

.png)

.png)