"A lo largo de los años hemos invertido mucho en nuestro equipo de datos de campo, centrándonos en la elaboración de calificaciones fiables. Si bien esto garantiza la precisión de nuestras valoraciones, no permite la escala a través de los miles de proyectos que los compradores están considerando."

Para más información sobre las tendencias en la adquisición de créditos de carbono, lea nuestro artículo"Key Takeaways for 2025". Compartimos cinco consejos basados en datos para mejorar su estrategia de adquisición.

Una cosa más: los clientes de Connect to Supply también tienen acceso al resto de herramientas de Sylvera. Esto significa que puede ver fácilmente las calificaciones de los proyectos y evaluar los puntos fuertes de cada uno de ellos, obtener créditos de carbono de calidad e incluso supervisar la actividad del proyecto (sobre todo si ha invertido en la fase previa a la emisión).

Reserve una demostración gratuita de Sylvera para ver en acción las funciones de adquisición y elaboración de informes de nuestra plataforma.

Para obtener información detallada sobre las últimas tendencias en precios, calidad y demanda, consulte nuestro completo informe sobre el estado de los créditos de carbono.

Los precios de los créditos de carbono de alta calidad alcanzan nuevos máximos al mantenerse las retiradas

Elmercado voluntario de carbono se mantuvo estable en el tercer trimestre de 2025, con unas retiradas estables y unas emisiones en ligero descenso respecto al trimestre anterior. Al mismo tiempo, nuestra mejor información sobre precios y compradores apunta a una mayor atención a la calidad y a la evolución de la demanda empresarial.

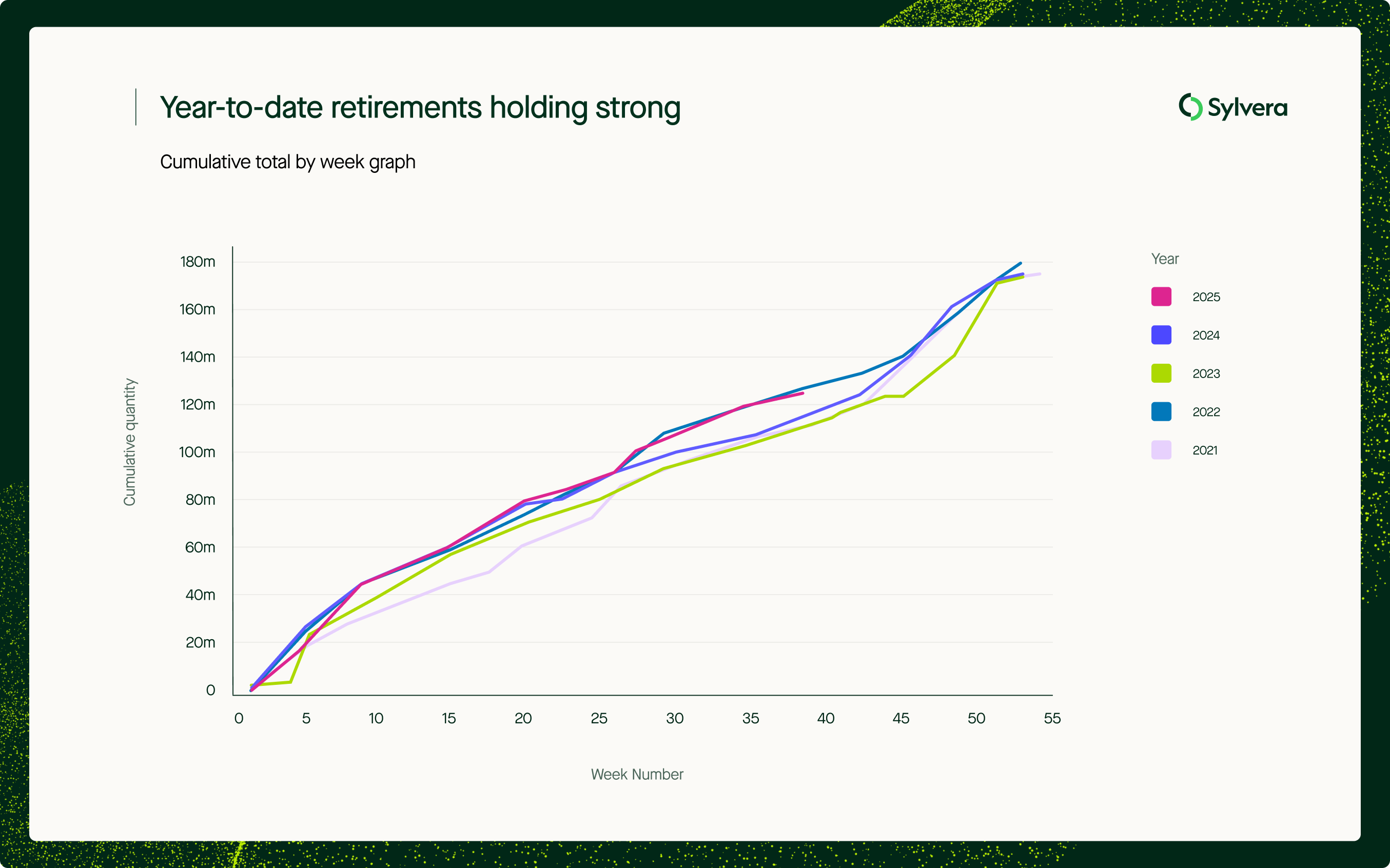

Las retiradas, el proceso por el que se utiliza un crédito para compensar emisiones y se deja de comercializar de forma permanente, alcanzaron los 33,54 millones en el tercer trimestre. Aunque esta cifra representa un descenso con respecto al récord de 40,45 millones de créditos retirados en el segundo trimestre, se acerca mucho a los niveles del tercer trimestre de 2024 (31,49 millones), y el volumen total de retiradas en 2025 se acerca a un máximo histórico. Las retiradas en lo que va de año en 2025 se mantienen firmes en 128,15 millones de créditos, por encima de los 120,61 millones del final del tercer trimestre de 2024 y ligeramente por detrás del récord de retiradas del año 2022, que alcanzó los 132,42 millones en este momento.

Por el lado de la oferta, las emisiones -la creación de nuevos créditos- ascendieron a 70,4 millones en el trimestre, por debajo de los 76,9 millones del segundo trimestre y los 68,8 millones del mismo periodo del año anterior.

Los precios premian la calidad

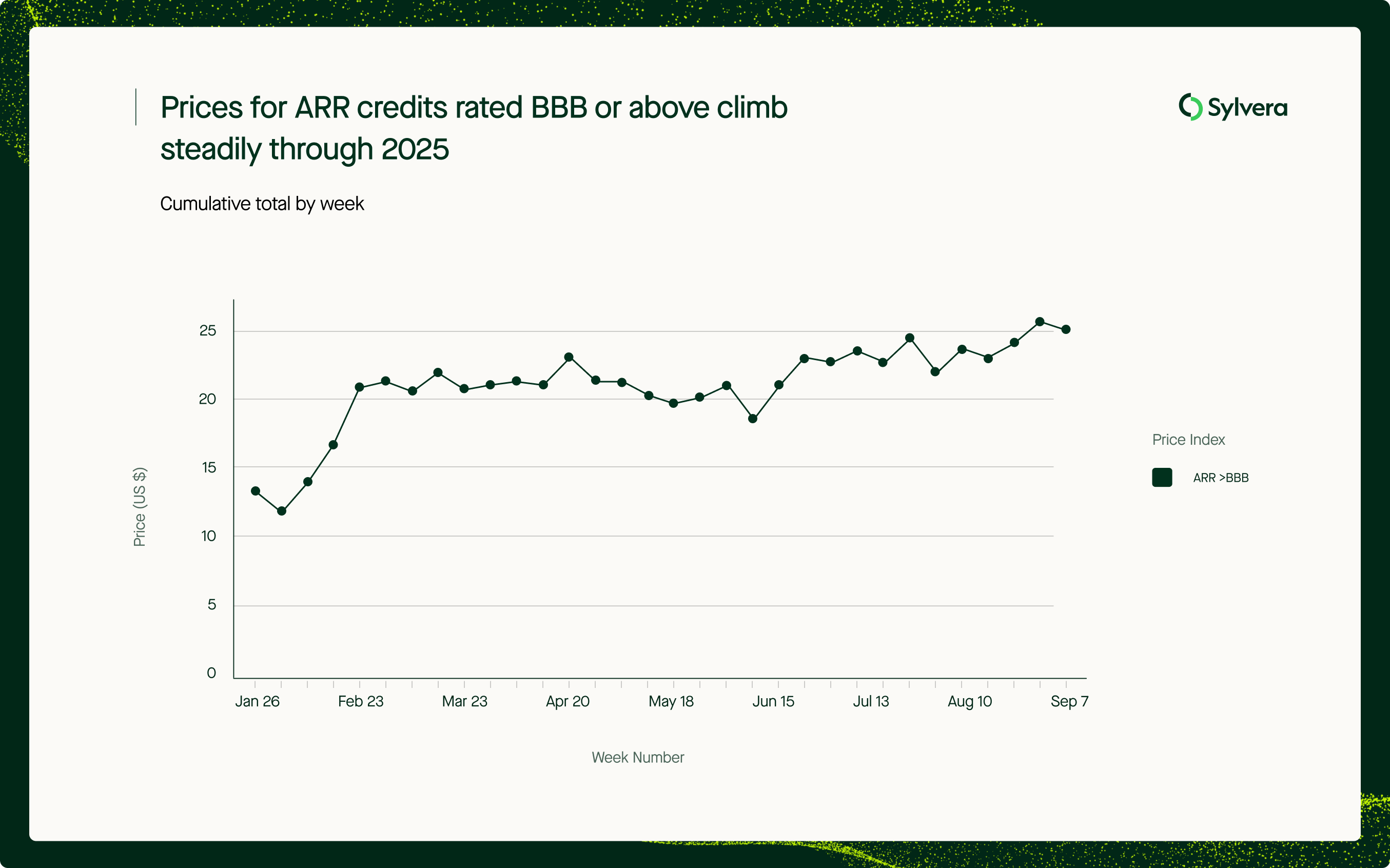

Nuestro nuevo Índice de Precios Ponderados por Calidad revela la aparición de una clara prima para los créditos ARR (forestación, reforestación y revegetación) de mayor calidad. Los precios de los créditos ARR con calificación BBB o superior han subido constantemente a lo largo de 2025, alcanzando los 24 dólares en septiembre, 10 dólares más que a principios de año.

Aaron Tam, Director de Producto de Sylvera, explicó: "El aumento de los precios ARR refleja un claro cambio en las prioridades de los compradores. Estamos asistiendo a la entrada en el mercado de una mayor proporción de proyectos de alta calidad, como proyectos TIST y proyectos con metodologías nuevas y más estrictas, lo que está haciendo subir los precios medios. El nivel de demanda que hemos observado a estos precios sugiere que los compradores están cada vez más dispuestos a pagar una prima por la integridad y el impacto climático demostrado, considerando estos proyectos como una inversión más segura y a largo plazo."

Más allá de los precios al contado del mercado actual, los precios futuros de los créditos ARR también muestran fortaleza: algunos promotores cotizan precios a plazo para las próximas cosechas de hasta 50 dólares o más, lo que indica una fuerte demanda de proyectos de eliminación de residuos naturales.

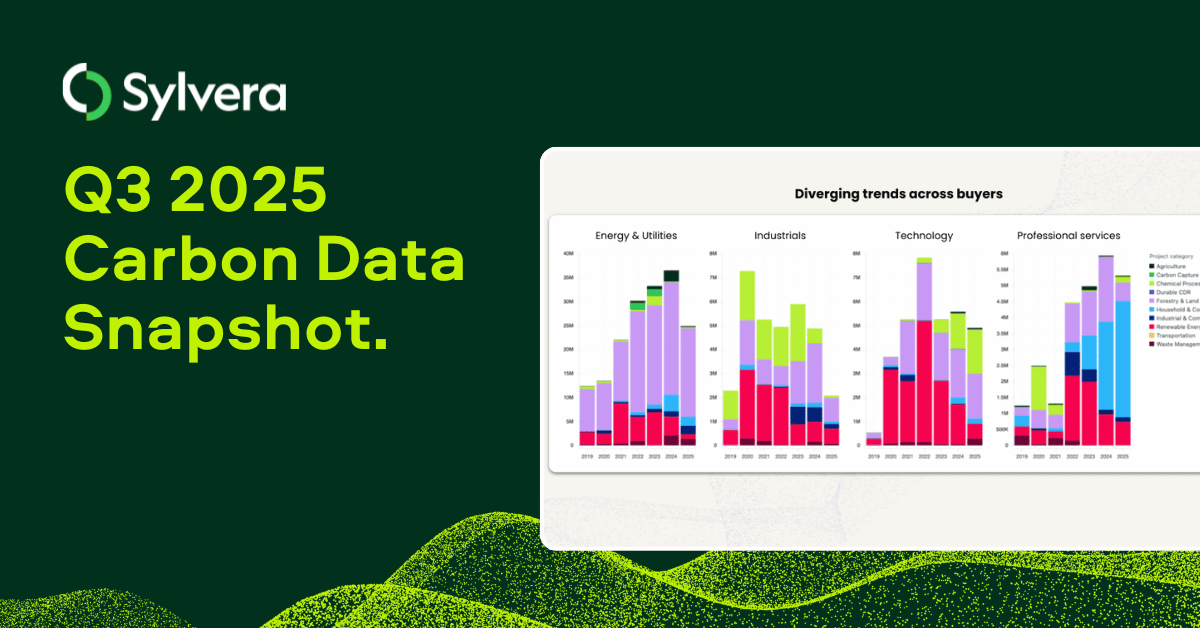

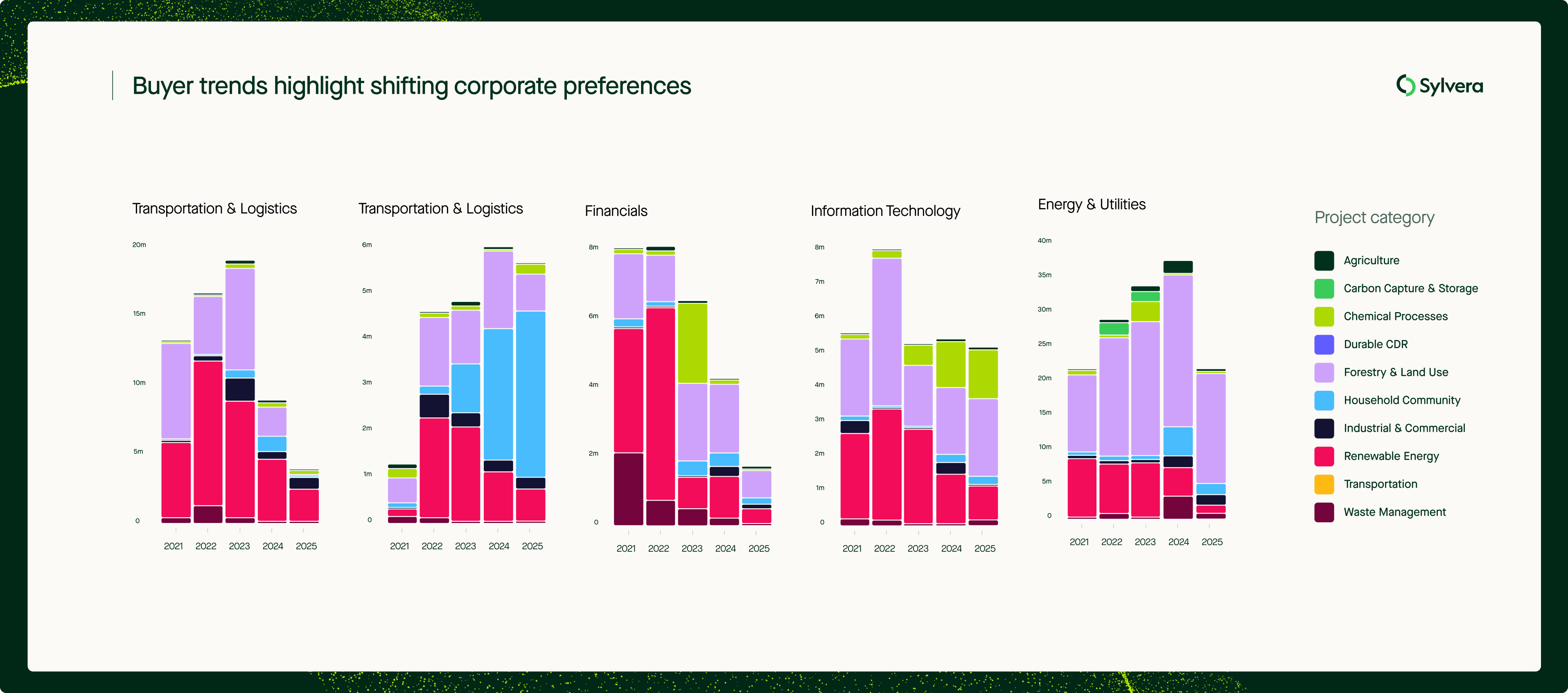

Las tendencias de compra ponen de relieve el cambio de preferencias de las empresas

Mientras tanto, el Directorio de Compradores de Sylverarevela cambios notables en la forma en que los distintos sectores enfocan la compra de créditos de carbono. Las últimas retiradas en 2025 indican que las empresas de servicios profesionales aceleraron su uso de créditos de carbono procedentes de proyectos de estufas, que ahora representan alrededor del 70% de las retiradas conocidas del sector. El uso de créditos de carbono de energías renovables siguió disminuyendo de forma constante en la mayoría de los sectores, y se redujo de forma más significativa entre las empresas tecnológicas, financieras y de servicios profesionales. Las empresas de transporte y logística constituyen una excepción a esta tendencia, ya que los créditos de energías renovables siguen representando el 60% de su demanda.

A pesar de la percepción de un retroceso en los compromisos climáticos corporativos, las empresas energéticas y de servicios públicos siguen dominando la demanda de créditos de carbono, representando cerca del 40% de las retiradas no anónimas en 2025, cifra comparable a la del año pasado.

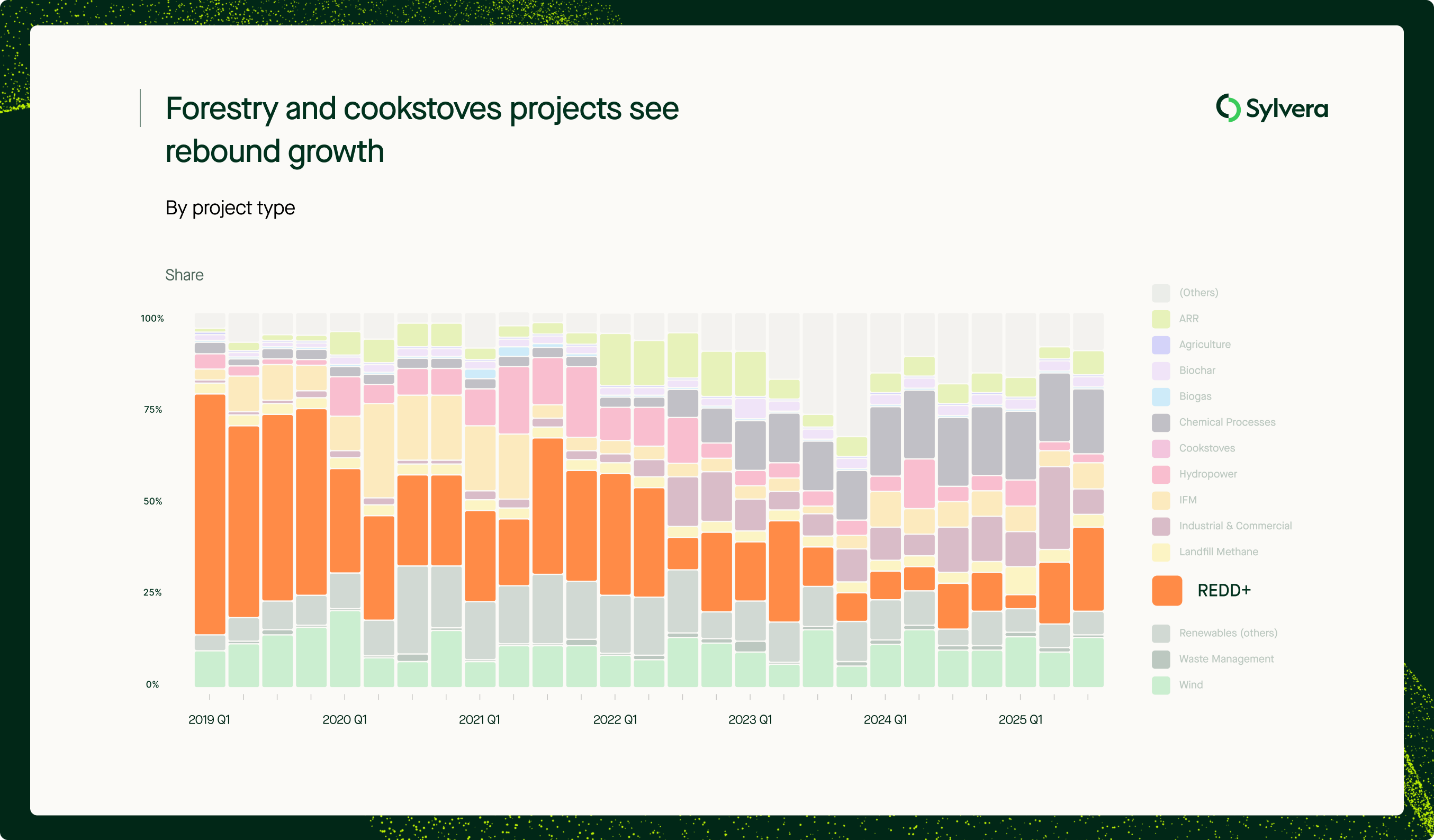

Registros y tipos de proyectos ver reequilibrio

La cuota de nuevas emisiones de Verra continúa su declive a largo plazo, cayendo al 28,09% en el tercer trimestre de 2025 frente al 39,2% del mismo periodo hace dos años, lo que refleja una desaceleración continuada desde que las emisiones de proyectos REDD+ de Verra alcanzaron su máximo en 2021. Por el contrario, BioCarbon Standard ha alcanzado una cuota récord del 21,16%, impulsada por las emisiones de varios grandes proyectos REDD+ en América Latina respaldados por la demanda regional.

Las emisiones de proyectos forestales tuvieron un buen comportamiento en el tercer trimestre. Los proyectos REDD+ experimentaron un repunte significativo, representando el 26,05% de las emisiones, frente al 16% del segundo trimestre y el 10% del tercer trimestre del año pasado. Esto sugiere una mayor confianza de los compradores en este tipo de proyectos, cuya calidad general ha mejorado gracias a la mejora de las metodologías, el seguimiento y la aplicación de normas más estrictas que abordan las preocupaciones anteriores en torno a la contabilidad y la adicionalidad.

Los créditos conformes ganan terreno

El volumen de créditos etiquetados por el CCP -aquellos alineados con los Principios Básicos del Carbono del Consejo de Integridad del Mercado Voluntario de Carbono- sigue creciendo. En lo que va de 2025, se han emitido 16,63 millones de créditos con etiquetas aprobadas por el CCP, lo que pone de manifiesto un cambio hacia normas reconocidas de calidad e integridad.

Mientras tanto, los mercados de cumplimiento se integran cada vez más con los sistemas voluntarios. Un total de 67,17 millones de créditos emitidos este año pertenecen a normas y metodologías que han sido aprobadas para su uso en la primera fase CORSIA, a reserva de recibir las autorizaciones de los países de acogida. Esto representa un tercio (33,3%) del total de créditos emitidos este trimestre, frente al 27,1% del mismo periodo hace dos años.

Perspectivas del mercado para el último trimestre

Los datos del tercer trimestre indican que el mercado avanza hacia una mayor madurez y sofisticación. La calidad se recompensa cada vez más, tanto a través de precios más altos como de la demanda corporativa de proyectos fiables. Los registros se están diversificando a medida que los compradores buscan garantías e integridad, mientras que los sistemas de cumplimiento como CORSIA están reduciendo la brecha entre los mercados voluntarios y los reglamentarios.

Allister Furey, Consejero Delegado de Sylvera, ha declarado: "La creciente prima para los créditos de alta calidad demuestra que la integridad es ahora un motor clave del valor. Los compradores son cada vez más selectivos y los promotores de proyectos responden con normas más estrictas.

Esta adecuación entre las expectativas de calidad y la demanda del mercado es fundamental para ampliar los mercados de carbono y conseguir un verdadero impacto climático con un menor coste económico".

A medida que 2025 entra en su último trimestre, estas tendencias indican un mercado que está madurando más allá de la mera cantidad, con la transparencia, la confianza y la preparación para el cumplimiento como su núcleo.

¿Quiere explorar usted mismo esta dinámica de mercado?

Nuestro paquete de inteligencia de mercado ofrece transparencia en todo el mercado con datos en tiempo real sobre precios, oferta y demanda.

💲 Datos de precios - Estimaciones al contado a nivel de proyecto, con más de 20.000 estimaciones alimentadas por ~300.000 transacciones.

📈 Datos de mercado - Emisiones y retiradas semanales, precios medios filtrables e integración de la oferta conocida.

🏢 Directorio de compradores: vea quién está retirando qué por sector, tipo, añada y geografía para validar la demanda.

Obtenga más información sobre Inteligencia de Mercado aquí, o solicite su demostración gratuita ahora.

Para obtener información detallada sobre las últimas tendencias en precios, calidad y demanda, consulte nuestro completo informe sobre el estado de los créditos de carbono.