“Over the years we’ve invested significantly in our field data team - focusing on producing trusted ratings. While this ensures the accuracy of our Ratings, it doesn’t allow the scale across the thousands of projects that buyers are considering.”

For more information on carbon credit procurement trends, read our "Key Takeaways for 2025" article. We share five, data-backed tips to improve your procurement strategy.

One more thing: Connect to Supply customers also get access to the rest of Sylvera's tools. That means you can easily see project ratings and evaluate an individual project's strengths, procure quality carbon credits, and even monitor project activity (particularly if you’ve invested at the pre-issuance stage.)

Book a free demo of Sylvera to see our platform's procurement and reporting features in action.

A version of this article was published originally on 14 April 2025, by SustainableViews, see here.

We are not heading for a zero-carbon world. We are heading towards net zero. A more achievable, albeit still immensely challenging, goal.

Despite, or even partly because our best plan incorporates overshooting multiple planetary boundaries, our collective response to the climate crisis remains slow. We are failing to stand up to the challenge set before us.

In recent months, we have seen both governments and businesses step away from commitments, finance flows disrupted and a symphony of distractions dragging attention away from our greatest existential threat.

The challenge we face requires a set of solutions that will transform how economies function – from drastically reducing emissions, developing breakthrough green technologies and developing the right skills and talent to support the global transition.

As part of this, the carbon markets have the potential to become one of the most powerful mechanisms for rapidly channelling finance towards meaningful climate action, with some estimations showing the market could be valued at over $1.1 trillion by 2050. Rather than backtracking, we must work to scale up this critical lever in our response to the climate crisis.

It is well-known that the market has faced its own set of reputational challenges in recent years, and efforts to improve its integrity and transparency are starting to pay off. But if we want to maximise the potential global carbon markets, it must also mature further as a well-functioning and trusted mechanism for change.

The state of play

One of the most acute challenges is that global carbon markets lack consistent data standards. Different registries, projects, and geographies all describe and store data about credits in varied ways.

Exacerbating the problem, the data we do have is stored within millions of pages of inconsistently structured documents, resulting in inefficiencies, higher transaction costs and making it harder to assess quality and mitigate risk. Inconsistent and hard to access data is undermining confidence, slowing adoption and, by extension, bottlenecking investment in the green transition.

For the market to mature, we need to fix these fundamental issues. Only then can the market move on from the past and flourish into a mature, trusted and investable asset class.

The Berners-Lee moment

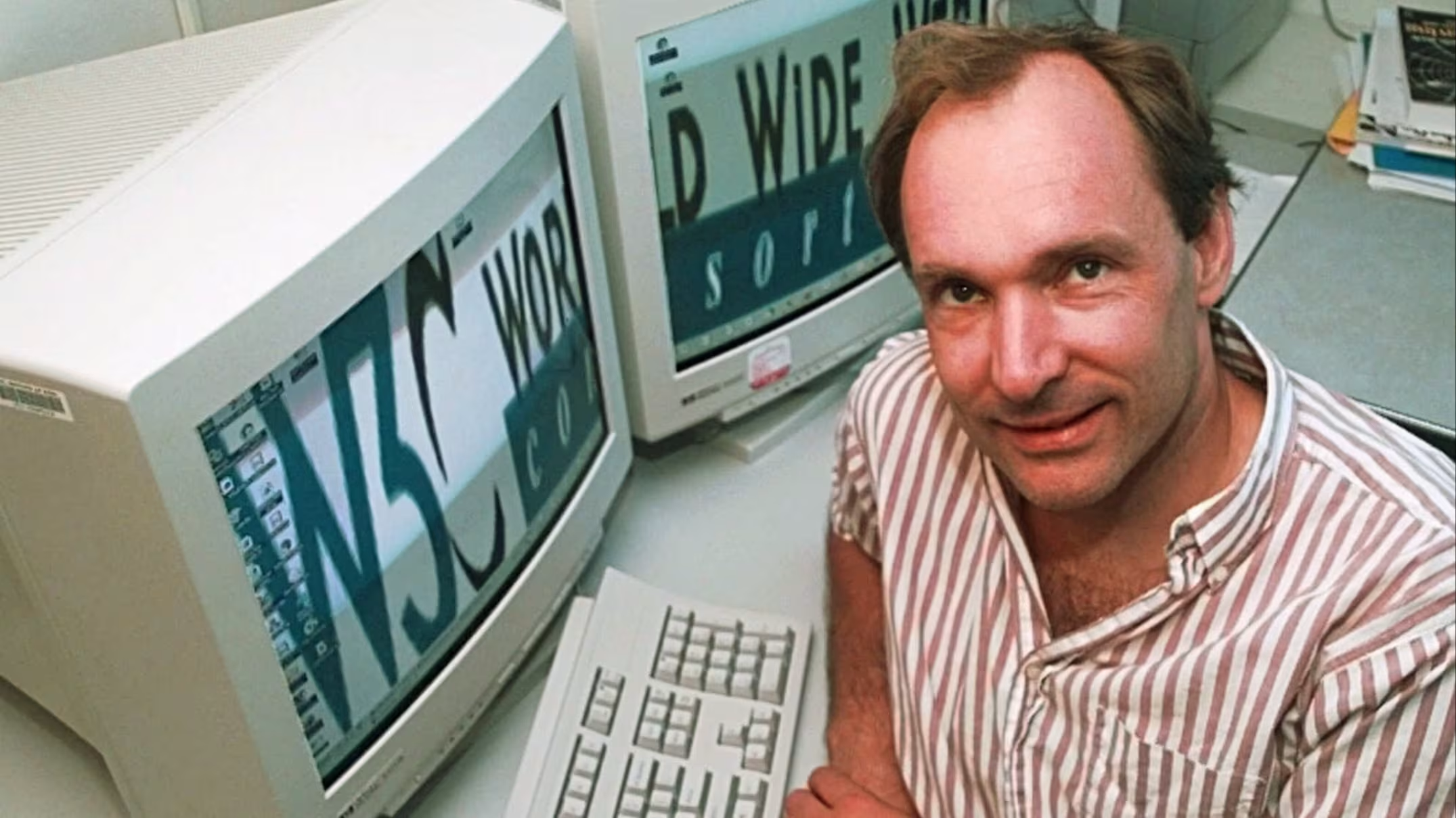

The internet was well described from a technical point of view since the 1970s in the form of TCP/IP protocol. These described how information should be transmitted between computers in a network. But it wasn’t until the 1990s that the internet boomed.

Pivotal to wide-scale adoption of the internet was a team working at CERN, and famously, Tim Berners Lee, who recognised the need to make it easier for users to actually ‘do’ things with the internet. Especially how to address the location of information regardless of the network, describe information, publish pages, and link between them.

WWW, HTML, HTTP and hyperlinks solved all of these needs, and together, transformed the internet from a collection of disconnected resources into an intuitive, navigable information system that anyone could use without specialised technical knowledge.

This is what those working in carbon markets must strive for if we are to achieve widespread adoption and realise the potential for climate impact.

A critical step towards this was taken recently with the launch of the Carbon Data Open Protocol (CDOP). A multi-stakeholder initiative led by GCMU, Sylvera, RMI, and S&P Global, with contributions from 30 leading businesses, non-profits, and public sector organisations, it aims to standardise definitions and carbon data across markets and geographies.

It will enable transparent, comparable, and high-quality data on credits, helping market participants discover, invest, verify the climate impact of credits, insure, trade, and ultimately use credits. This is alongside facilitating interoperability between different registries and data systems, allowing for seamless transactions and data flows across platforms.

Industry-led, multi-stakeholder collaboration

Just as the early pioneers of the internet were able to create the infrastructure that enabled its success, the CDOP could significantly scale carbon markets, unleashing their power to drive finance towards real climate action.

Similar to how the internet needed global backing to succeed, CDOP’s success will be determined by the level of collaboration from a wide range of players across the carbon market ecosystem. Buyers, investors, project developers, NGOs and any organisation that would like to shape the next chapter of global carbon markets are encouraged to share their views.

The future of carbon markets and global climate action depends on it.

A version of this article was published originally on 14 April 2025, by SustainableViews, see here.

About CDOP

The Carbon Data Open Protocol (CDOP) is a cross industry, multi-stakeholder collaboration designed to standardize data describing carbon crediting projects and carbon credits across markets, geographies, and activity types.

CDOP is developing a open data protocol to increase transparency, consistency, and interoperability in carbon markets, enabling the scale needed to meet global climate targets.

CDOP is supported by 52 leading organizations from the private, nonprofit, and public sectors. It draws on the work of complementary initiatives including the Climate Action Data Trust (CAD Trust), the ICVCM’s Continuous Improvement Work Program, the World Bank’s Carbon Market Infrastructure Working Group (CMIWG), and others.

CDOP is committed to maximizing alignment with emerging frameworks under Article 6 of the Paris Agreement and to developing a protocol that is maintained as a public good.