The market’s most trusted view of carbon credit quality.

Trusted ratings, market intelligence, and biomass data - built to direct capital to projects and commodities that truly deliver.

Three ways to assess project quality

Whether you’re assessing project quality, demonstrating it to buyers, or de-risking early-stage development - Sylvera has the right rating for every need.

What sets our Ratings apart

Lorem ipsum dolor sit amet consectetur. Diam in et laoreet nisl facilisi magna pellentesque. Viverra euismod cursus ullamcorper sapien tincidunt aliquam sed.

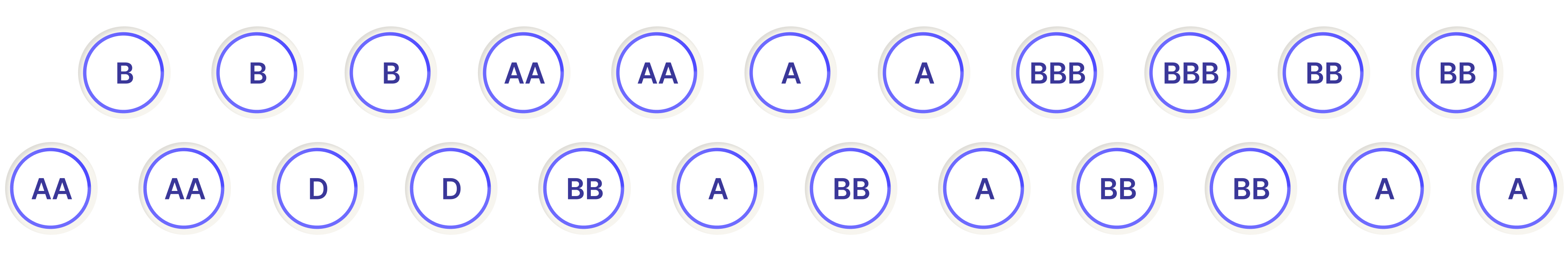

Typical carbon ratings

Ratings features

Whether you’re assessing project quality, demonstrating it to buyers, or de-risking early-stage development - Sylvera has the right rating for every need.

See Sylvera Ratings in action

From project screening to portfolio monitoring-see how buyers and developers use Sylvera to make confident, defensible carbon decisions.

FAQs

Lorem ipsum dolor sit amet consectetur. Diam in et laoreet nisl facilisi magna pellentesque. Viverra euismod cursus ullamcorper sapien tincidunt aliquam sed.

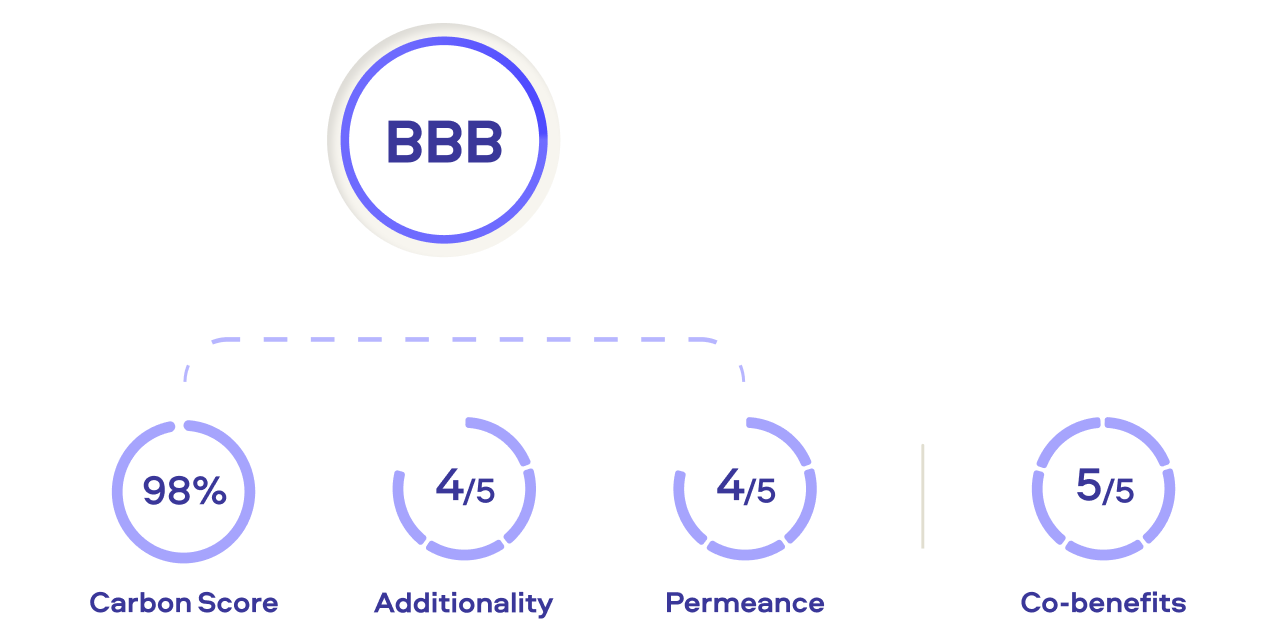

Sylvera Ratings differ by providing independent, science-led assessments built on project-specific frameworks and proprietary data, rather than static or generic scoring models.

Each rating is grounded in expert-designed frameworks by project type and supported by peer review, continuous monitoring, including earth observation data for nature-based projects. Ratings are updated as new evidence emerges, allowing users to track delivery risk over time rather than relying on one-off assessments.

Buyers use Sylvera Ratings to compare project quality consistently, manage delivery risk, and support defensible procurement and claims decisions.

Ratings provide an independent quality signal that helps screen out high-risk supply, prioritise credible projects, and justify decisions internally to sustainability, risk, and audit teams. They are most effective when used alongside market and pricing intelligence to assess risk-adjusted value, not just headline quality.

No - higher-rated projects do not always cost more, but they often offer better risk-adjusted value.

Sylvera’s study shows that price premiums tend to correlate with higher quality, particularly where delivery risk is lower. However, buyers frequently use ratings to avoid overpaying for projects that do not deliver expected outcomes, helping optimise portfolios rather than simply paying more.

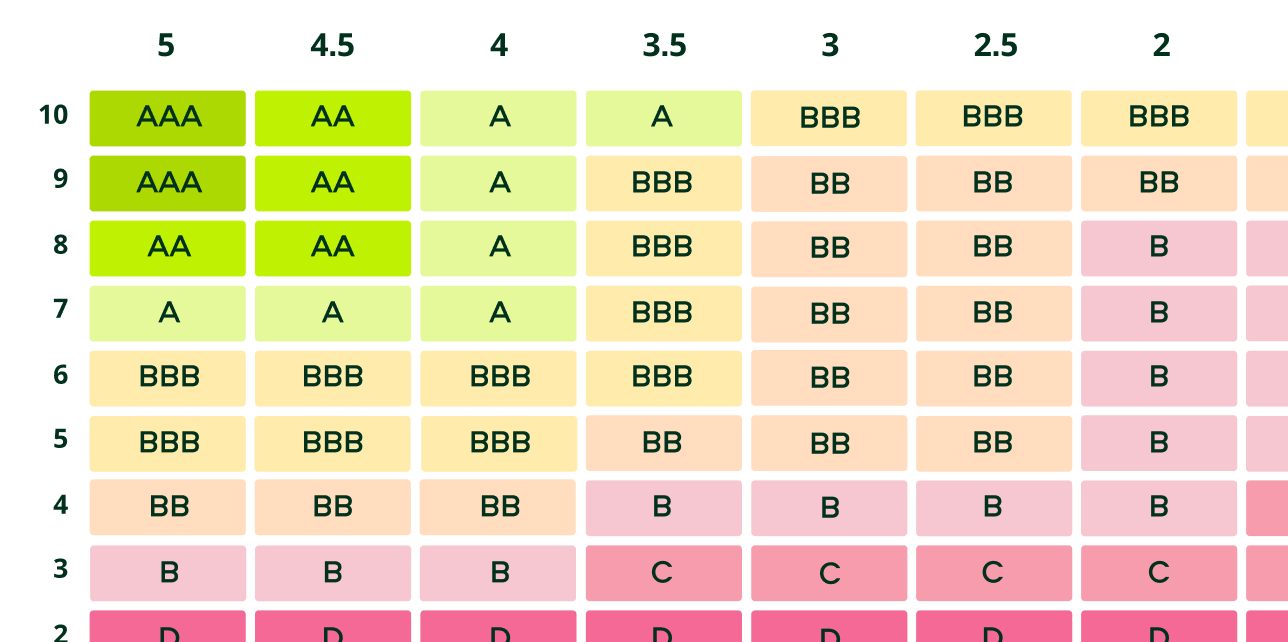

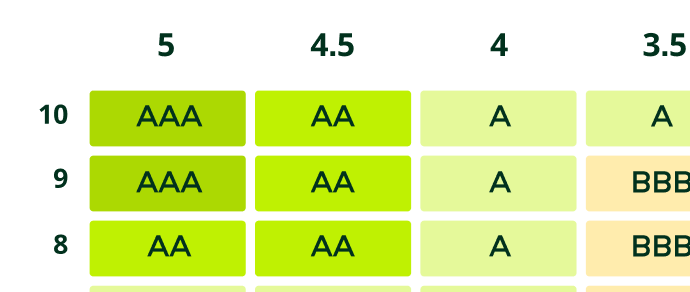

Yes - Sylvera Ratings enable consistent comparison across project types while respecting their underlying differences.

Each project type is assessed using a tailored framework, but outputs are standardised so users can compare relative quality and risk across nature-based, avoidance, and removal projects. This helps buyers and investors make portfolio-level decisions, and developers to benchmark and price their project without relying on inconsistent or qualitative comparisons.

Yes - developers use Sylvera’s analysis to identify risks, improve quality and maximise asking price, particularly before projects reach the market.

Pre-issuance and early-stage assessments highlight where project design, monitoring, or assumptions may affect quality. While developers cannot influence scores, they can address identified risks to strengthen project credibility and improve market readiness ahead of issuance.

Sylvera Ratings are used by corporates, institutional investors, project developers, and public bodies globally.

They support carbon procurement, investment decision-making, project development, and policy analysis across voluntary and compliance-adjacent markets. Users rely on ratings to bring consistency, independence, and transparency to increasingly complex carbon market decisions. See how our customers use them.

Book a demo

Explore the carbon data powering real-world investment and procurement decisions.