"A lo largo de los años hemos invertido mucho en nuestro equipo de datos de campo, centrándonos en la elaboración de calificaciones fiables. Si bien esto garantiza la precisión de nuestras valoraciones, no permite la escala a través de los miles de proyectos que los compradores están considerando."

Para más información sobre las tendencias en la adquisición de créditos de carbono, lea nuestro artículo"Key Takeaways for 2025". Compartimos cinco consejos basados en datos para mejorar su estrategia de adquisición.

Una cosa más: los clientes de Connect to Supply también tienen acceso al resto de herramientas de Sylvera. Esto significa que puede ver fácilmente las calificaciones de los proyectos y evaluar los puntos fuertes de cada uno de ellos, obtener créditos de carbono de calidad e incluso supervisar la actividad del proyecto (sobre todo si ha invertido en la fase previa a la emisión).

Reserve una demostración gratuita de Sylvera para ver en acción las funciones de adquisición y elaboración de informes de nuestra plataforma.

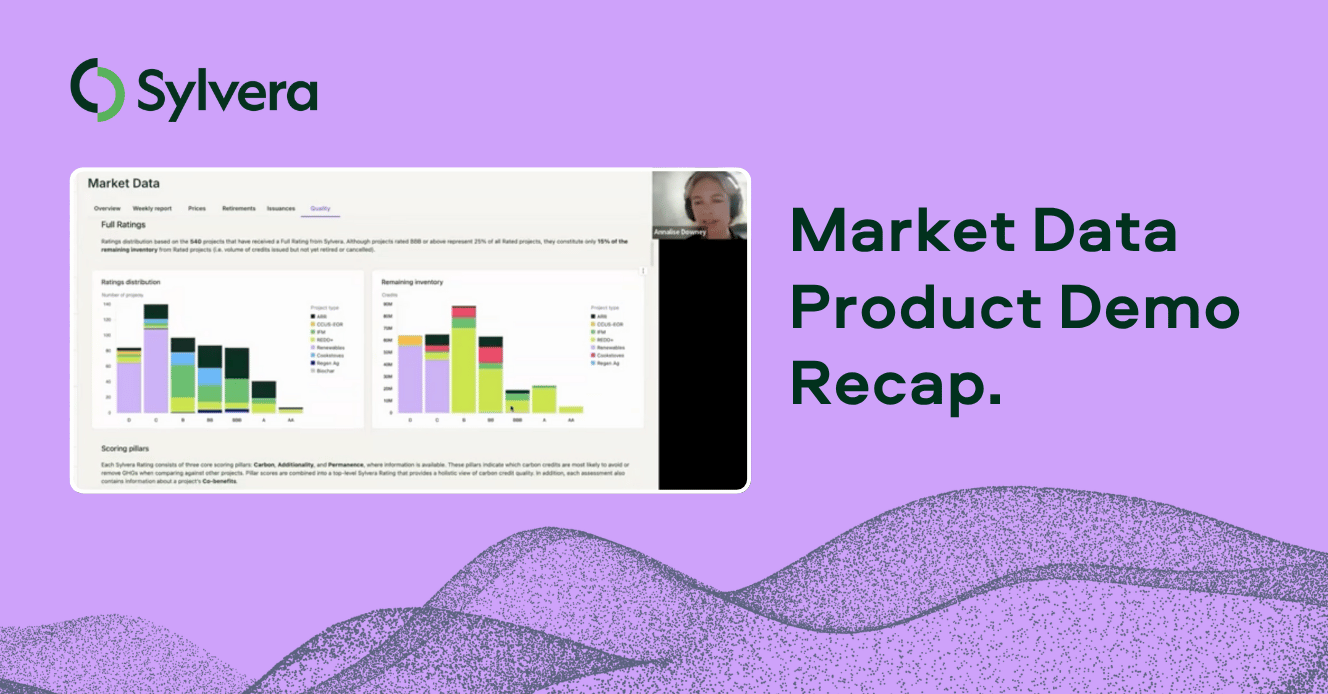

Annalise Downey, Jefa de Consultoría Climática, y Aaron Tam, Director de Producto de Datos de Mercado, ofrecieron una demostración en directo de nuestro recientemente lanzado Datos de mercado recientemente lanzado.

En esta recapitulación, desglosamos las áreas y los casos de uso de los Datos de Mercado, mostrando cómo las partes interesadas del mercado del carbono pueden aprovechar los datos en tiempo real sobre la calidad de los créditos, las tendencias de precios y los movimientos del mercado para tomar decisiones estratégicas más inteligentes.

¿Cuál es la situación actual del mercado del carbono, según Market Data?

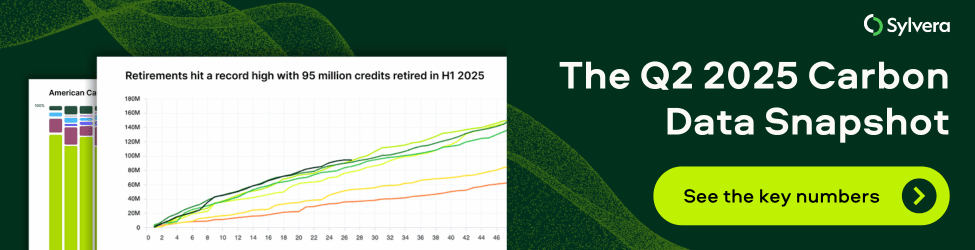

El mercado de créditos de carbono arrojó noticias positivas en el primer semestre de 2024, con un aumento de las retiradas hasta 95 millones de toneladas, la cifra semestral más alta registrada. Este crecimiento vino acompañado de un cambio significativo en la calidad, ya que las retiradas con calificación Doble B+ aumentaron hasta el 57% en el primer semestre, frente al 52% en 2024, lo que demuestra que el mercado se centra cada vez más en los créditos de mayor calidad.

Los proyectos forestales y de uso de la tierra, incluidos ARR, IFM y REDD, siguen dominando el mercado, representando el 31% de los créditos emitidos, con unos precios medios en el mercado primario de 24 dólares para los proyectos ARR, que se elevan a 27 dólares para los proyectos con calificación triple B+. Se observa una tendencia especialmente notable en las categorías de proyectos industriales y comerciales, con un aumento espectacular de los proyectos de destrucción de HFC y metano de vertedero, que representan el 19% de las emisiones, frente al 7,9% del primer semestre anterior.

Consulte las cifras más detalladas en nuestro informe sobre datos de carbono del segundo trimestre de 2025.

Casos prácticos: ¿Quién utiliza los Datos de Mercado y por qué?

Compradores: Los equipos de aprovisionamiento utilizan los datos de mercado para establecer presupuestos precisos y justificar las decisiones de gasto, al tiempo que optimizan su enfoque temporal y de contratación para determinar si los contratos al contado o los acuerdos de suministro ofrecen un mejor valor. Estos datos resultan especialmente útiles cuando los equipos de compras necesitan vincular sus decisiones con resultados estratégicos, sobre todo cuando trabajan con directores financieros o departamentos financieros para alinear el gasto y justificar su enfoque.

Inversores: Los equipos de inversión utilizan los Datos de Mercado para identificar oportunidades emergentes mediante la detección de tendencias de la demanda y limitaciones de la oferta en diferentes tipos de proyectos y geografías. La plataforma apoya sus esfuerzos de captación de fondos y ventas demostrando la tracción del mercado y el posible retorno de la inversión, ayudándoles a construir casos de negocio convincentes para tipos de proyectos específicos en geografías concretas. Además, los datos ayudan a reducir el riesgo en la construcción de carteras al proporcionar información sobre la volatilidad de los precios y los patrones de fiabilidad del suministro.

Lea nuestro blog: ¿Cuáles son los distintos tipos de datos sobre el mercado del carbono y cómo pueden utilizarse?

Visión general de la plataforma de datos de mercado

Market Data integra múltiples flujos de datos que se actualizan diariamente. Esto incluye una extensa base de datos de precios que se integra con los datos de oferta y retirada de los registros y las calificaciones de calidad únicas de Sylvera para proporcionar una imagen completa del mercado.

La plataforma se abre con un panel de control general que presenta tendencias de alto nivel en precios, volúmenes, emisiones y distribución de la calidad.

Los informes semanales proporcionan la información más reciente sobre el mercado, haciendo un seguimiento de las recientes retiradas, identificando a los principales retirados, destacando las nuevas emisiones y, lo que es más importante, señalando los nuevos proyectos añadidos a los registros como indicadores de la próxima oferta.

La sección de análisis de precios revela dónde se concentra la actividad del mercado y muestra la distribución de precios por tipo de proyecto, incluido un análisis de primas por calidad que demuestra claras preferencias del mercado.

Las perspectivas regionales revelan más detalles y comparaciones específicas por países, por ejemplo que los proyectos ARR de África tienen sistemáticamente precios más altos que los proyectos comparables de Asia y América.

Perspectivas de precios: Primas por calidad y añada

La sección de precios de Datos de Mercado permite a los usuarios profundizar en precios del carbono como las claras primas de mercado tanto por la calidad del proyecto como por los beneficios colaterales, ya que los proyectos mejor valorados obtienen sistemáticamente mejores precios. Una tendencia emergente muestra fuertes primas por añadas, donde las añadas de 2024 exigen primas significativas sobre los precios de referencia de 2018, lo que refleja el creciente interés de los compradores corporativos por créditos frescos dentro de una estrecha ventana de añadas de 3-5 años.

Aunque la media de los proyectos ARR es de 27 dólares por tonelada para los créditos de calidad, la plataforma muestra una gran variabilidad de precios, con ofertas de hasta 60 dólares por tonelada, lo que demuestra el amplio espectro de precios en función de las características específicas del proyecto y del posicionamiento en el mercado.

Jubilaciones y tendencias de la oferta

La sección de jubilaciones de Market Data muestra permite a los usuarios comparar, por ejemplo, tipos de proyectos, distribuciones de calidad o dinámicas de registro.

Por ejemplo, los datos recientes mostraban un gran volumen de retiradas de proyectos domésticos y comunitarios, al tiempo que demostraban una clara evolución del mercado hacia una mayor calidad, con un menor número de proyectos de menor calificación que se retiraban a medida que los compradores se volvían más selectivos. Verra mantuvo su posición como el mayor registro de retiradas, aunque aumentaron las retiradas de Gold Standard.

Por el lado de la oferta, la sección de emisiones revela la misma agrupación de datos que las retiradas. En este caso, se observa una notable ralentización de las emisiones de Verra, atribuida principalmente a las actualizaciones metodológicas que aplican recortes a las emisiones de proyectos, mientras que las emisiones del American Carbon Registry aumentan. También muestra un fuerte movimiento hacia las emisiones basadas en la tecnología, lo que refleja tanto el enfoque de los promotores de proyectos como los patrones de demanda del mercado.

Análisis y comparación de la calidad de los proyectos

Las empresas son cada vez más conscientes de los problemas de calidad, y cada vez son más las que descartan los proyectos de alto riesgo mediante clasificaciones o evitan categorías enteras de proyectos con problemas conocidos.

El análisis de calidad de la plataforma revela patrones de distribución exhaustivos en todos los tipos de proyectos y regiones, con un desglose detallado.

¿Cuál es el futuro de los datos de mercado?

Aaron esbozó cuatro áreas de desarrollo clave para la evolución de los Datos de Mercado de Sylvera.

El primer objetivo consiste en ampliar la cobertura de la oferta conocida, abordando la opacidad en torno a los créditos realmente disponibles para la compra frente a los simplemente emitidos pero aún no retirados. La mejora de la visibilidad en tiempo real de la disponibilidad de la oferta sigue siendo una prioridad.

[Actualización: se ha añadido recientemente a la plataforma en Suministro conocido].

La segunda área de interés es el conocimiento de los precios a plazo, ya que muchos compradores están interesados en acuerdos de compra plurianuales para asegurarse un suministro de alta calidad en los próximos años. El equipo está desarrollando análisis y modelos de trayectoria para la evolución de los precios a plazo en distintos tipos de proyectos y plazos.

La tercera área se centra en el análisis de la demanda de los compradores corporativos, que ofrece información valiosa a promotores e inversores mediante el análisis de los datos de jubilación y los patrones de consumo para comprender quién compra créditos, qué atributos específicos buscan y su disposición a pagar primas por las distintas características de los proyectos.

Por último, el análisis del impacto de las políticas examinará cómo afectan las decisiones normativas a los mercados de créditos de carbono, empezando por un informe exhaustivo sobre el mercadoCORSIA , que ya está disponible y que puede consultar aquí. Este análisis irá más allá CORSIA y abarcará diversas decisiones políticas que afectan tanto a los mercados voluntarios como a los de cumplimiento a escala mundial, ayudando a las partes interesadas a comprender cómo podrían afectar los cambios normativos a los futuros patrones de precios y demanda.

Resumen: ¿Qué incluyen los datos de mercado de Sylvera?

Inteligencia de mercado diaria con información en tiempo real sobre tendencias de precios, patrones de calidad y actividad de jubilación.

Análisis interactivos que le permiten filtrar y desglosar por tipo de proyecto, geografía, registro y calificaciones de calidad.

Datos de precios propios procedentes de más de 100.000 cotizaciones de más de 40 fuentes, que le ayudarán a comparar precios justos.

La integración calidad-precio muestra cómo las calificaciones de Sylvera se traducen en primas de mercado

Empiece con su propia demostración de Datos de Mercado

¿Quiere empezar a utilizar Datos de mercado en su toma de decisiones estratégicas? Nos encantaría ayudarle. Solicite una demostración para ver nuestra plataforma de datos de carbono líder del mercado en acción para su empresa.

.avif)